Budgeting for Retirement: How to Manage Expenses

Retirement marks a significant transition in life that requires careful financial planning to ensure a comfortable and secure future. It is crucial to manage expenses during retirement and balance fixed and variable costs while maintaining a lifestyle that aligns with one’s desires and needs. This guide offers practical advice on budgeting for retirement, addressing key […]

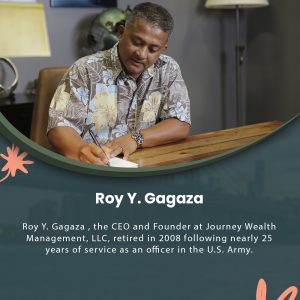

Read More